You’re Already Behind. Forge AI Is How You Catch Up.

You know that feeling. Token starts moving. Your brain clocks the setup. Fingers hit the keyboard.

Too late.

By the time you’ve typed the trade, it’s gone. Chart moved. Window closed. You’re watching green candles that should’ve been yours.

This is manual trading in 2026. Markets never stop. Opportunities last seconds. Unless you’ve cracked immortality and given up sleep, you’re missing most of them.

We got tired of losing to the clock. So we built something about it.

February 17th, 2026 — 12:00 AM UTC. Forge AI goes live.

The Problem

Manual trading hits a wall. Doesn’t matter how sharp your analysis is or how dialed your strategy gets — you’re still limited by reaction time, screen time, and the annoying human need to do things besides stare at charts.

Here’s the math that keeps us up at night: Crypto runs 24/7/365. That’s 8,760 hours per year. The most obsessive trader can realistically monitor maybe 3,000 of those hours. You’re blind for 70% of market activity.

Some people try alerts. Set notifications, jolt awake when something triggers, execute manually. Problem is, by the time you’re actually conscious and processing what just happened, the move’s already over. Alerts tell you what was. They don’t help you act.

Others run their own bots. Works great if you can build them, keep them running, and constantly update strategies as conditions shift. Most traders aren’t full-time devs. They end up debugging code instead of trading.

We wanted a different setup. You define the strategy — rules, risk parameters, conditions. Autonomous agents handle execution. You make the calls that matter. They do everything else.

What Forge AI Does

Forge AI runs autonomous trading agents on Solana. Each agent operates independently. Monitors conditions. Executes trades based on your parameters. No hand-holding required once they’re live.

Think less “bot” and more “team.” Each agent has a specialty. You build your squad based on strategy and risk tolerance.

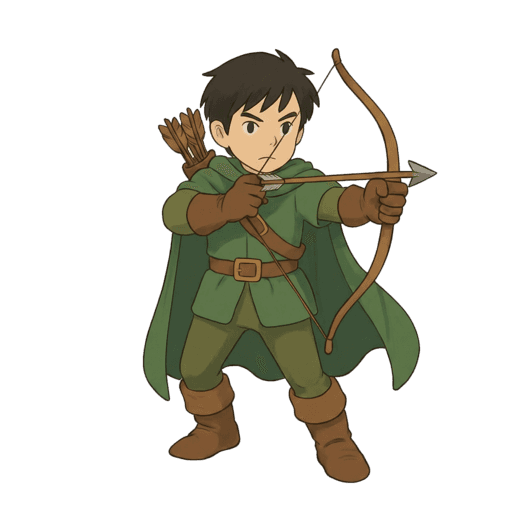

Launching With the Fighter

The Fighter is the first agent class available at beta launch.

Fighters are built for volatility. Higher risk tolerance. Aggressive position sizing. Fast reactions to momentum shifts. If your strategy is riding volatile moves rather than fading them, the Fighter fits.

We’re launching with one class intentionally. We want the core experience dialed before expanding. The Fighter gives us — and you — a focused proving ground for autonomous execution in real market conditions.

Coming Soon: The Full Roster

More agent classes roll out as beta progresses:

Rangers — Precision. Quick entries and exits with tight parameters. Catching wicks, fading pumps at specific levels. Surgical.

Mages — Pattern recognition. Monitor for specific technical conditions across multiple timeframes and tokens. When signals align with your criteria, they move.

Defenders — Risk management. Less about finding entries, more about protecting positions. Trailing stops, scaling out at targets, cutting losses. Pairs well with aggressive agents.

Rogues — Inefficiency hunters. Arbitrage opportunities, pricing discrepancies, temporary mispricings. They work the margins where small edges exist for those fast enough.

Gamblers — Exactly what it sounds like. High-risk, momentum-focused, willing to chase moves others pass on. Not for everyone. Perfect for some.

The vision: full team composition. Defenders managing risk while Fighters chase momentum while a Rogue captures arb on the side. That’s where this is headed.

Why Public Beta

We’ve been building in private for months. Infrastructure is solid. Stress-tested. Simulated. Small group of testers running it through real conditions. Core functionality works.

But trading systems only get truly tested in live markets with real money on the line. Simulation doesn’t capture actual chaos. Network congestion. Unexpected volatility. Edge cases nobody anticipated. That stuff only surfaces when real traders are really trading.

Public beta means stress-testing at scale. We want feedback. We want to see what breaks. We want to learn how traders actually use this versus how we imagined they would.

This isn’t a polished launch dressed up as beta. There will be bugs. Features won’t work the way you expect. Frustration will happen. We’re saying that upfront because honest feedback beats pretending everything’s perfect.

We’re offering early access to something we think genuinely improves trading. In exchange, we’re asking for patience with rough edges and honest reports when things go sideways.

Day One: What’s Live

February 17th, 12:00 AM UTC.

The Fighter goes live. Basic configuration options. Set your parameters, define your strategy, deploy your first agent. Start conservative. Learn how it behaves before scaling.

Dashboard shows what your agents are doing. Trade history. Performance metrics. Current positions. Conditions being monitored. You won’t be flying blind.

Risk controls built in at protocol level. Max position sizes. Daily loss limits. Kill switches for individual agents or everything at once. We didn’t build this to encourage reckless behavior. Use the controls.

Documentation covers basics: Fighter configuration, what parameters mean, common strategy setups. Not exhaustive. Enough to get moving.

Community channels go live same time. Report issues, share what works, ask questions, connect with other beta users. We’ll be active. Bugs reported in community typically get addressed within 24 hours during beta.

After Launch

Week one is stability. Monitoring everything, pushing fixes fast, gathering data on real-world performance. Expect daily updates.

End of week one: Performance dashboards with deeper analytics roll out. Not just what agents did — why. Which conditions triggered trades. How timing affected outcomes. Where slippage happened. Data for refining strategies, not just observing results.

Month one: Advanced customization. Initial release gives you parameters to adjust. Next phase lets you build complex conditions — multi-factor triggers, conditional logic chains, cross-asset dependencies. For sophisticated strategies, this is where it gets interesting.

New agent classes roll out as we validate stability and gather Fighter feedback. Each class gets announced before release so you can plan.

Tournament mode is coming. Agents competing under controlled conditions. Leaderboards showing what actually works. Not just bragging rights — tournament data becomes a learning resource for everyone.

Who This Is For

Forge AI isn’t for everyone. Saying that upfront saves time.

Not for you if:

You’re brand new to trading without strategies to execute. Agents run rules you define. If you don’t know what rules you want, agents can’t figure that out. Learn basics first.

You want guaranteed returns or a system that prints money without input. Markets don’t offer guarantees. Forge AI gives you better tools — but tools still require skill.

You have zero tolerance for bugs or early-stage software. Wait for a more polished release.

Built for you if:

You have defined strategies but lose edge to execution limitations. You know what to trade. You have rules. You’re losing because you can’t watch everything or react fast enough. Agents solve that.

You’ve tried building your own bots but spent more time on code than trading. Forge AI handles infrastructure. You focus on strategy.

You want to scale beyond human limits. More markets monitored. Faster reactions. Agents multiply what you can do.

You’re willing to give feedback and help shape the product. Beta participants aren’t just users — they’re contributors to what this becomes.

The Risk Part (Read This)

We build trading tools. We don’t give financial advice.

Forge AI doesn’t guarantee profits. Markets are risky. Automated systems lose money just like manual trading. Faster execution means faster execution of whatever strategy you chose — good or bad.

Don’t trade with money you can’t lose. Standard advice because it’s critical. Agents remove friction. They don’t remove risk.

Start small during beta. Even experienced traders with high conviction should learn how this works with amounts that won’t hurt if something goes wrong.

Beta is inherently riskier. Bugs, unexpected behavior, integration issues — more likely in early releases. We’re building safeguards, but nothing’s perfect. Treat beta as higher risk than established software.

Getting Access

Early supporters and community members get priority. If you’ve been following from the start, check Discord or email for access details before public launch.

New users: join the waitlist at forgeai.gg. We’re releasing access in waves — partly for server load, partly to ensure we can actually support the users we onboard. Position matters.

When you get in, read documentation before deploying agents. Understand parameters. Use minimal position sizes to start. First week is for learning, not earning.

What’s Next

This beta is the beginning.

The core tech — autonomous agents executing based on user-defined parameters — works. Public beta proves it at scale and shows us what to improve. What comes after depends on what we learn and where markets go.

Vision hasn’t changed. Trading shouldn’t require 24/7 attention. Execution shouldn’t bottleneck good strategies. Traders should compete on insight and risk management, not clicking speed or staying awake longest.

Forge AI is infrastructure for that future.

February 17th is when we start building it together.

$FORGE: foRgE7d5FRtvQ2jf9yhV9Cnd1LMB3rxk6dpE7HYdzGk

Trading involves substantial risk of loss. This is not financial advice.